A Biased View of Independent Financial Advisor copyright

Wiki Article

Examine This Report on Tax Planning copyright

Table of ContentsThe Ultimate Guide To Independent Financial Advisor copyrightSome Of Ia Wealth ManagementSome Ideas on Independent Investment Advisor copyright You Should KnowThe Ultimate Guide To Private Wealth Management copyrightSome Known Details About Independent Financial Advisor copyright The Greatest Guide To Independent Investment Advisor copyrightSome Of Investment RepresentativeGetting My Private Wealth Management copyright To WorkWhat Does Ia Wealth Management Do?

They generate cash by charging you a charge for each trade, a-flat monthly fee or a share paid on the buck number of possessions being handled. Traders finding best specialist should ask a many concerns, such as: an economic consultant that works to you will not end up being the same as an economic specialist whom deals with another.Based whether you’re selecting a wide-ranging monetary plan or are simply just shopping for expense assistance, this question are vital. Economic analysts have actually various methods of charging their clients, and this will frequently depend on how many times you assist one. Definitely ask in the event that specialist uses a fee-only or commission-based program.

Private Wealth Management copyright - Truths

Whilst you may need to added some work to find the right economic consultant, the work is generally worth it if advisor gives you good information and assists place you in a much better financial position.

Vanguard ETF offers commonly redeemable immediately with the issuing fund apart from in massive aggregations well worth vast amounts (https://papaly.com/categories/share?id=5ae85fbc345f4fe897f82c8be2177d5f). ETFs tend to be susceptible to industry volatility. When purchasing or selling an ETF, you will spend or receive the market price, that might be basically than web asset value

More About Investment Consultant

Generally speaking, though, a financial advisor could have some type of instruction. When it’s perhaps not through an academic system, it is from apprenticing at a monetary advisory company (https://pagespeed.web.dev/analysis/https-www-lighthousewealthvictoria-com/drv8epdit8?form_factor=mobile). Men and women at a company that are nevertheless discovering the ropes tend to be labeled as associates or they’re an element of the administrative team. As noted early in the day, though, numerous advisors originate from some other industries

Indicators on Independent Investment Advisor copyright You Should Know

This means they must place their clients’ desires before their own, on top of other things. Various other monetary experts tend to be members of FINRA. This can imply that these are generally brokers which also provide expense information. In place of a fiduciary requirement, they legitimately must follow a suitability standard. This means that there's a fair basis due to their investment referral.Their brands frequently say every thing:Securities permits, alternatively, are more in regards to the sales part of investing. Financial analysts that happen to be in addition agents or insurance coverage agencies tend to have securities certificates. When they immediately buy or offer stocks, securities, insurance coverage services and products or provide monetary advice, they’ll want specific permits associated with those items.

The Ultimate Guide To Ia Wealth Management

Constantly be sure to ask about financial advisors’ fee schedules. To obtain these records by yourself, look at the firm’s Form ADV that it files using SEC.Generally communicating, there are two different pay buildings: fee-only. private wealth management copyright and fee-based. A fee-only advisor’s only kind of payment is through client-paid fees

Whenever attempting to understand simply how much a monetary advisor expenses, it’s important to know there are a number of settlement techniques they might make use of. Here’s an overview of everything you might come across: economic analysts can get paid a portion of the general possessions under management (AUM) for handling finances.

An Unbiased View of Tax Planning copyright

59percent to 1. 18percent, normally. lighthouse wealth management. Usually, 1percent is seen as the industry requirement for a million bucks. Lots of analysts will lower the percentage at greater amounts of assets, thus you are paying, say, 1percent for first $1 million, 0. 75percent for the following $4 million and 0Whether you need an economic consultant or not depends upon how much you have in assets. You should also consider your own level of comfort with money administration subject areas. When you yourself have an inheritance or have recently enter into a large sum of cash, then a monetary consultant could help answer your economic questions and manage your hard earned money.

Financial Advisor Victoria Bc for Beginners

Those distinctions may seem obvious to individuals inside the investment sector, but some consumers aren’t conscious of them. They might contemplate economic planning as similar with expense administration and advice. And it’s correct that the outlines within vocations have become blurrier in earlier times several years. Financial investment analysts tend to be increasingly concentrated on offering alternative economic preparing, as some people take into account the investment-advice piece become pretty much a commodity and tend to be looking for wider expertise.

If you’re pursuing alternative planning information: an economic coordinator is appropriate if you’re seeking broad financial-planning guidanceon the expense profile, but other parts of your own strategy too. Look for those that name on their own monetary coordinators and have potential coordinators if they’ve attained the qualified monetary coordinator or chartered financial expert designation.

The Basic Principles Of Investment Representative

If you need financial investment information first off: if you more helpful hints believe your financial strategy is during sound condition general however you need assistance picking and supervising your own investments, a good investment advisor will be the path to take. This type of individuals are often signed up investment analysts or are employed by a firm that is; these analysts and consultative companies are held to a fiduciary standard.If you wish to delegate: This setup could make good sense for very active people who merely do not have the time or tendency to participate in into the planning/investment-management process. Additionally it is one thing to think about for earlier traders that are concerned with the potential for intellectual fall and its particular effect on their ability to deal with unique finances or financial investment profiles.

Some Ideas on Investment Consultant You Need To Know

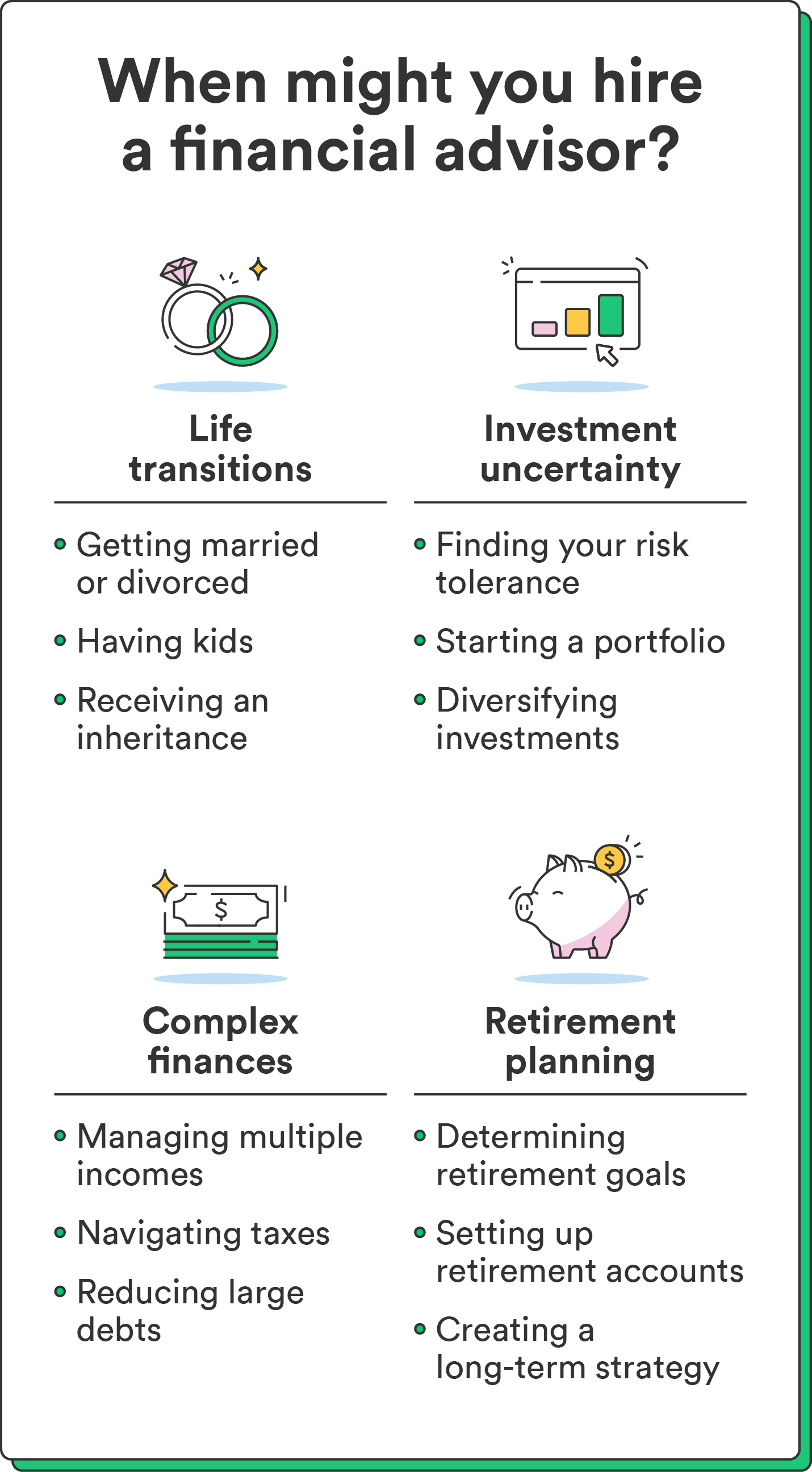

The writer or writers dont own shares in just about any securities mentioned in this article. Know about Morningstar’s article plans.Just how close you're to retirement, eg, or even the impact of significant existence occasions such as marriage or having children. However these items aren’t beneath the command over an economic planner. “Many take place arbitrarily and aren’t some thing we could affect,” states , RBC Fellow of Finance at Smith School of company.

Report this wiki page